Payroll & Tax Filing

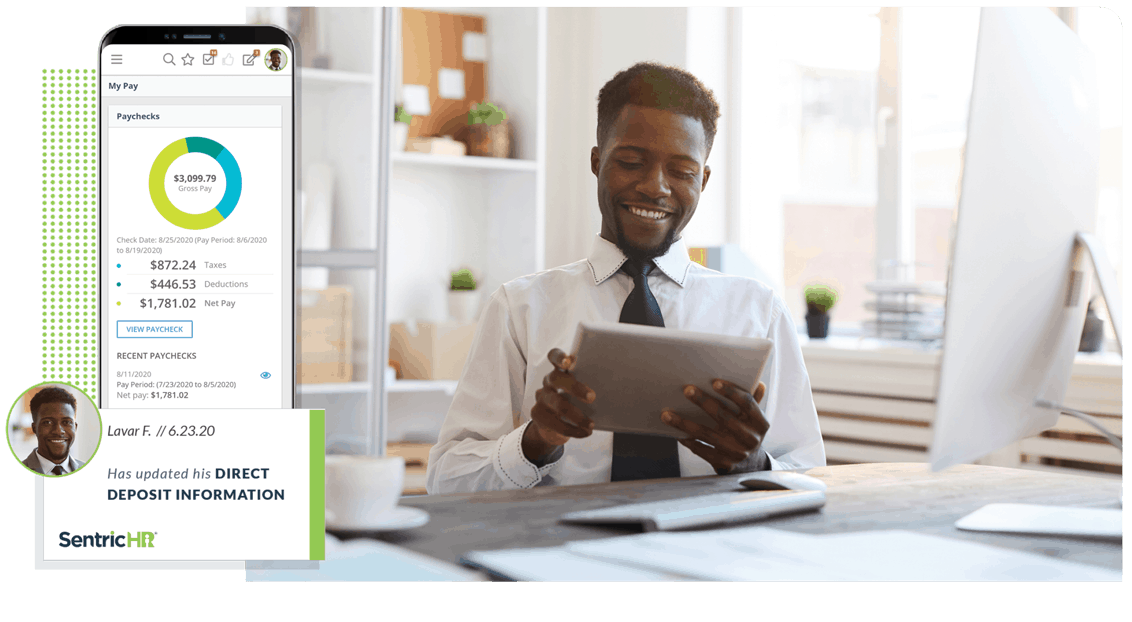

Compliant, accurate, timely – that’s payroll with SentricHR.

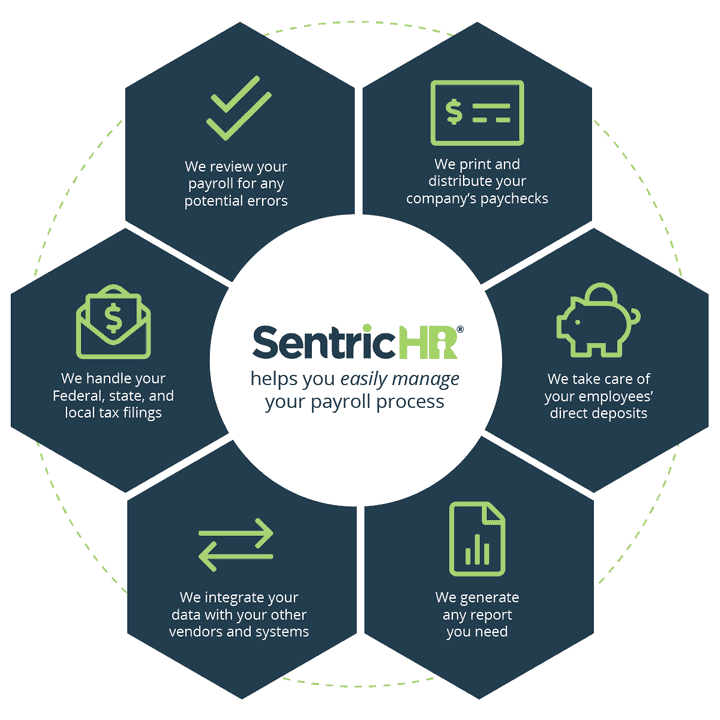

Your Payroll Processes – Done

- As a full-service payroll provider, we handle all the background processes so you can spend less time on forms and filing and more on the things that matter.

- We process payroll, print and distribute paychecks, file taxes, process Form W-2, and more.

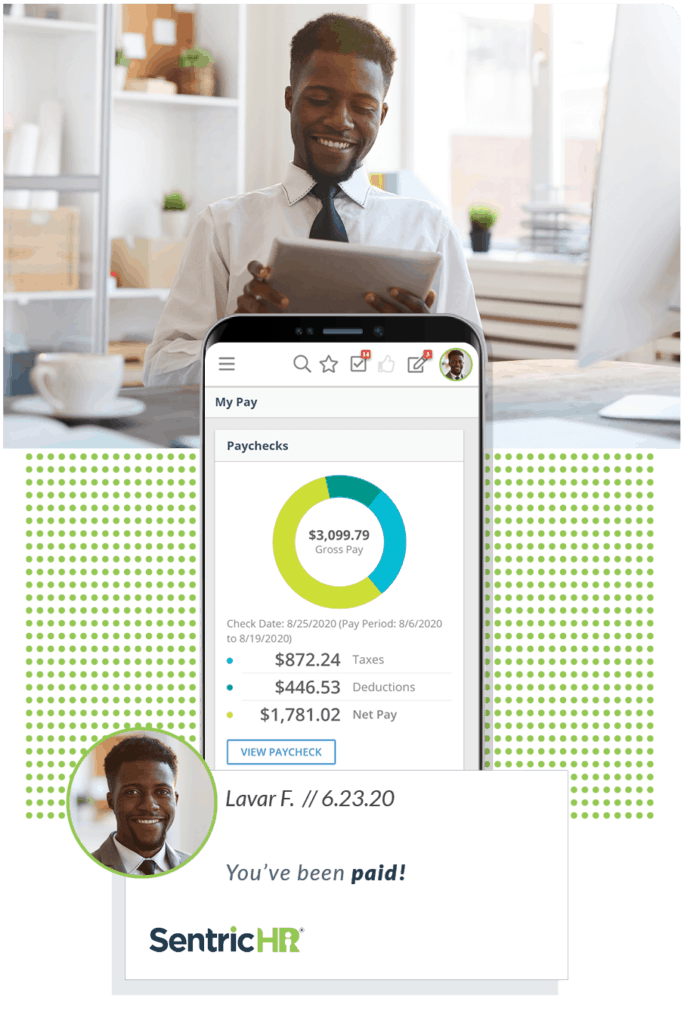

Payroll That’s Accurate Every Time

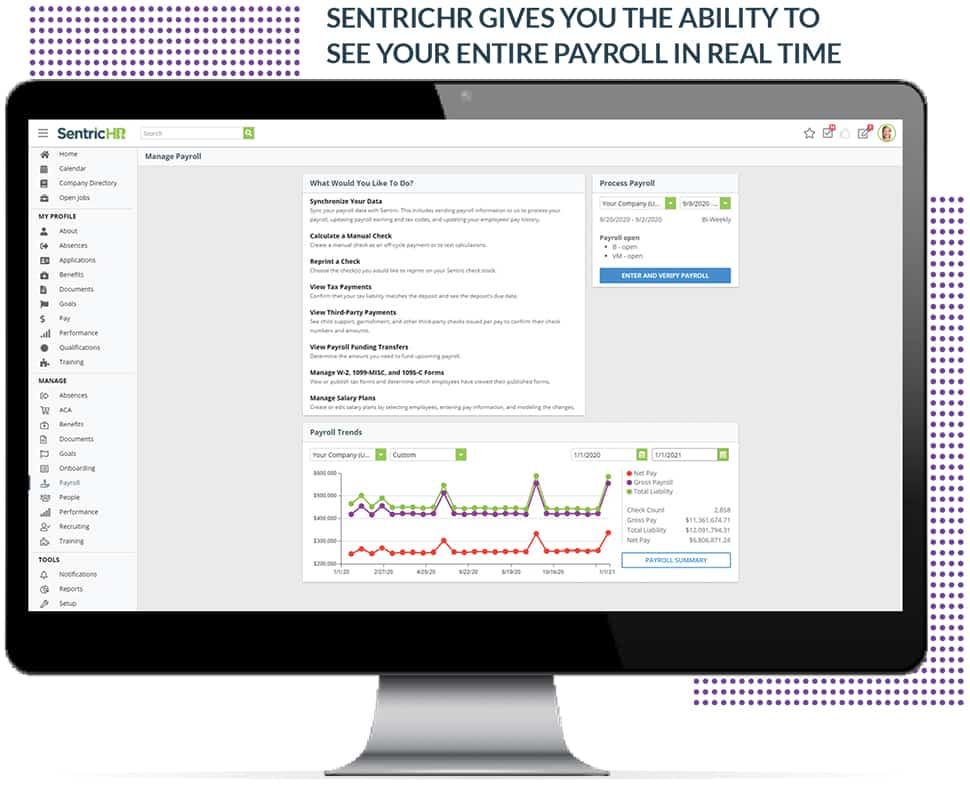

- We make sure each and every paycheck is just the way you want it. We give you the ability to see your entire payroll in real time, including absences, benefits deductions, and gross-to-net calculations.

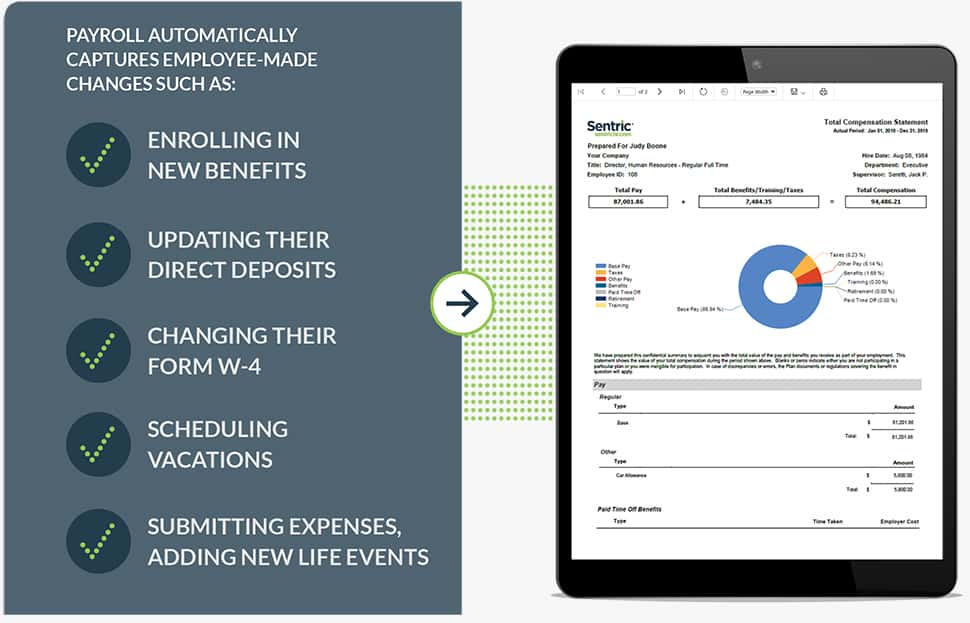

- Any last-minute changes are automatically captured so you can be certain everything is up to date before we begin processing.

- Our built-in audit tools check the data to ensure it’s approved and authorized. If anything is amiss, like critical missing data or excessive values, we’ll be alerted so your payroll stays accurate.

Tax Filing & Year-End Services

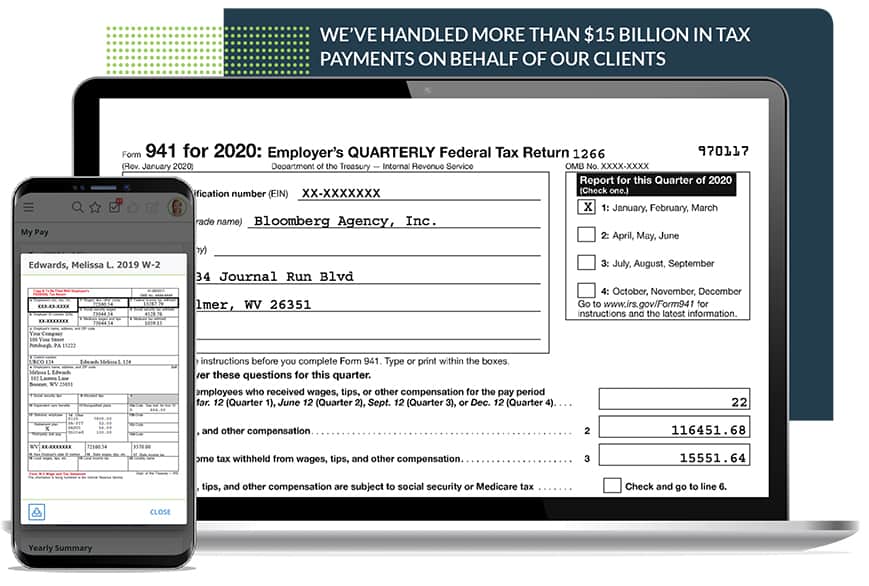

Leave your tax filing and end-of-year stress where it belongs: behind you. As a full-service provider, we take care of everything you need, from calculating and depositing your taxes to filing your forms at the right place at the right time. Our certified tax experts safely and accurately handle your:

- Federal, state, and local payroll taxes

- Forms 940 & 941

- Forms W-2 & 1099

- Forms 1094-C & 1095-C

Payroll Experts By Your Side

Paychecks are an important part of your employee’s life, so it’s important to get them right. That’s why you receive personal support from our certified team of US-based payroll experts. They do more than process your payroll – they have your back and help you navigate every pay period.

Other Payroll & Tax Filing Features

Payroll Reporting & Analytics

Easily identify trends, interpret data, and create reports with our analytic dashboards.

ACA Support

We’ll help you process, print, and file your Forms 1094-C and 1095-C, plus track company measurement periods and employee ACA status and coverage.

Paycheck Calculator

Make gross-to-net and net-to-gross calculations for off-cycle paychecks and print them right in your office. Easily send taxes and deductions to your next payroll batch.

Data and Third-Party Connections

Connect everything you need to payroll – your general ledger, retirement administrators, garnishments, and more.

Frequently Asked Payroll & Tax Filing Questions

Are you still looking to learn more about Payroll & Tax Filing for your business? These Frequently Asked Questions can help you find the answer.

What are the benefits of using payroll software?

When it comes to payroll processing, using payroll software can reduce errors and ensure compliance while helping you save time and money. Learn more.

How do I choose a payroll provider?

Choosing the right payroll provider will depend on your unique business and workforce needs. In general, look for a provider that prioritizes data security, helps you with payroll and tax compliance, and offers the reports you need.

How can I save money on payroll?

Automating your payroll can reduce costly errors and make it easier to manage overtime and other potentially unnecessary fees. Payroll software and automation also provide real-time reporting that your HR department can use to improve operations. Learn more.

How do I ensure payroll compliance?

Payroll compliance means following all Federal, state, and local laws. To ensure payroll and tax compliance, you need to understand the various wage, hour, taxability, and reporting requirements. This can be complicated, which is why we created a handy eBook that will help you stay compliant. Learn more.

How do I fix payroll errors?

Payroll errors can happen no matter how experienced you are. Luckily, familiarizing yourself with common payroll errors and their solutions can help you prevent them in your workplace. Learn more.